Changes to Delphi Funds

20.11.2019

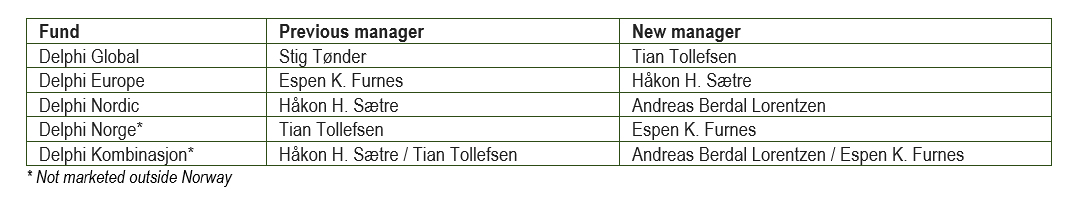

Stig Tønder has decided to pass on the baton after 25 years with Delphi Funds. As a result, we are now making a number of changes. New to the management team is Andreas Berdal Lorentzen.

A manager leaving Delphi Funds is not something that happens every day. It has only happened twice before in the funds' history. With the aim of creating a robust set-up for the years to come, we are now making changes that affect all the funds.

"First of all, we want to thank Stig for his efforts on behalf of Delphi Funds over a number of years. Stig has been key to the development of our operations. In addition to managing Delphi Global since 2006, he also managed a Norway mandate and Delphi Kombinasjon* before then," says Bård Bringedal, Chief Investment Officer – Equities at Storebrand Asset Management.

"My years at Delphi Funds have been exciting and informative, both as a manager in constantly changing finance markets and with regard to developing the operations. I've been with Delphi for my entire working life, so I have mixed emotions about passing on the baton. At the same time, a change is tempting. We have a good action plan for passing on the fund manager responsibility. Not only for Delphi Global but also for all the funds. That also feels good," says Stig Tønder.

Delphi Global and Delphi Europe

Tian Tollefsen will be Delphi Global's new manager. He has managed Delphi Norge* since August 2017. In Delphi Funds, he has worked closely with Håkon H. Sætre, who has managed Delphi Nordic since March 2017 and managed Delphi Norge* for 10 years before then. Sætre will now take over the management of Delphi Europe.

"Together with Ivar Harstveit, who is an analyst on the team, Tian and Håkon have further developed Delphi Funds' screening model and created a format that we believe will be even better suited to the portfolio structure of the funds with the largest investment universes. Going forward, we want to increasingly add fundamentals and data as early as in the screening process, since we regard this as an efficient supplement to Delphi's traditional trend screening process," says Bård Bringedal.

"We believe having a close collaboration across the global fund and European fund provides clear benefits, and the same is true for the funds that invest in our Nordic domestic markets. A just as clear desire for the collaboration between Tian and Håkon to continue also led to the decision to appoint Håkon as the new manager of Delphi Europe," says Bringedal.

Delphi Nordic and Delphi Norge*

With management changes decided on for two funds, the next step was to find a good, permanent solution for Delphi Nordic and Delphi Norge*. Andreas Berdal Lorentzen was chosen as the new manager of Delphi Nordic, while Espen K. Furnes will assume responsibility for Delphi Norge*.

"We're pleased that Andreas is now returning to Storebrand Asset Management, this time as the manager of Delphi Nordic. Andreas was a manager in Storebrand's Norwegian equities team from 2008 to 2017 before he chose to work outside the Group for a period. During that period, he also dealt with Swedish shares, and this has given him valuable experience for a Nordic mandate," says Bård Bringedal.

"I'm delighted to be starting in Delphi Funds, which I know well from my time as a manager with Storebrand. I have a lot of experience of Norwegian and Swedish shares, and am now looking forward to having the whole Nordic region as my new domestic market," says Andreas Berdal Lorentzen.

Andreas and Espen will also take over the management of Delphi Kombinasjon*, with Andreas as the manager of the fund's Nordic share portfolio and Espen as the manager of the fund's Norwegian interest-rate portfolio.

"After managing European shares for a number of years, it feels right with a change for me too when we first make changes. I will now be able to focus on the Norwegian market, a market I know very well from before. The proximity to the companies makes me extra excited about assuming responsibility for Delphi Norge* and the Norwegian interest-rate portfolio," says Espen K. Furnes.

The Delphi way will remain

These changes do not affect Delphi's management concept. The funds will still be managed the Delphi way, which includes both a trend analysis and a fundamental analysis. While the concept remains the same, there will be a continuous need to develop how we apply the concept in our management.

"In order to obtain further confirmation of the companies' value-creating potential, we have for a while now been developing a screening model that takes both the price trend and fundamental trend into consideration. We are now going to use this screening model when managing the global fund and European fund. The funds managed in our domestic markets will also benefit from this screening. At the same time, the proximity to the Nordic companies remains an important element that we want to safeguard in the best possible way during the investment process," concludes Bård Bringedal.

Responsibility for the various funds' portfolios will be transferred during the period ending on 1 January 2020.

* Not marketed outside Norway