Investment process

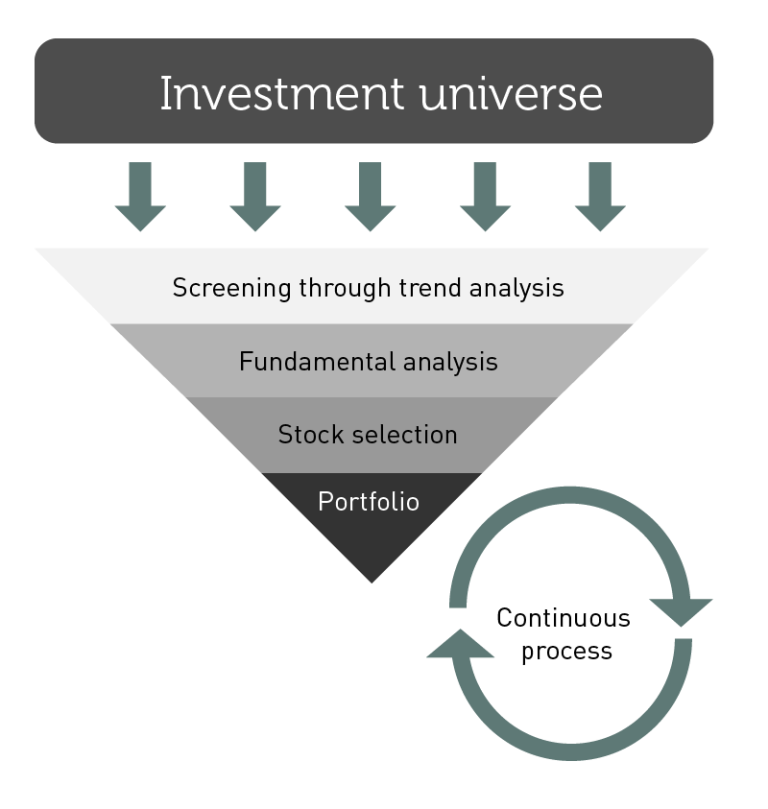

All Delphi's funds utilize the same investment process. Based on each fund’s investment universe, ideas are generated through screening of different variables – with particular focus on individual companies.

Delphi's investment team work closely together and shares ideas across the funds' investment universes. There are no investment committees, and each lead manager has ultimate decision making authority for their own fund.

The screening process

Using screening tools such as Bloomberg and Vikingen, we examine a large number of graphs where the companies’ price charts are in focus. We are always searching for positive and long-term repricing opportunities.

The trend screening helps us identifying companies which have delivered value over a period of time. The trends also reflect the dynamics in the economy, the financial markets and the companies’ earnings in a very good way. By utilizing trends we also reduce the risk of the managers' fundamental research being faulty, which is by far the largest source of poor returns for managers and investors alike. The odds for a company that has delivered solid results over the previous quarters or years to keep on delivering are far greater than the odds that a poor historical performer will suddenly improve. History shows that trends in economic indicators, interest rate levels, product lifecycles and company earnings cycles last longer than one usually thinks. This is what we try to take advantage of.

It is important to note that we distinguish short-term trends from long-term trends. Short-term trends are often influenced by psychology, and is an area for short-term investors, while long-term trends often reflect the fundamental strength in a company, which is our area of expertise. We are long-term investors (time horizon for each investment is normally 2-3 years), and as such will not change our view overnight. This also implies that we are not buying into falling stock prices, i.e. we are not typical value managers. Rather, we wait for a trend to be established before we consider buying into the stock.

The ABC of trends:

- Duration – the longer the trend, the higher probability it will continue

- Volatility – we like companies with low volatility, and thus higher predictability

- Relative strength – higher value creation relative to the market, the sector, competitors etc.

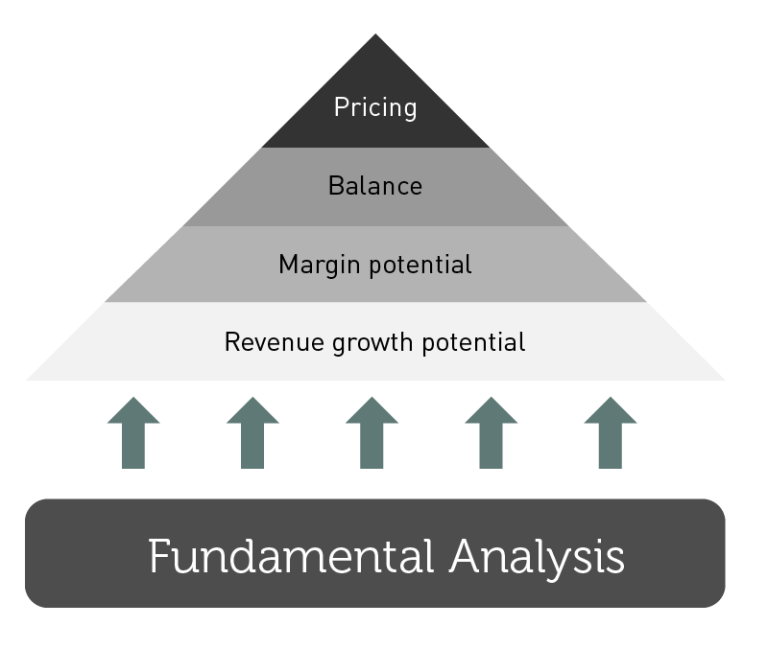

Delphi’s fundamental research

In our fundamental research, we focus on two aspects. First, we research why a stock is performing so well, i.e. why investors are so interested in this particular stock. We seek to identify if there are real changes in the fundamental outlook in a company. If there is, then secondly we examine the likelihood of sustainability in the positive fundamental trend.

We use our extensive knowledge and understanding of the specific sectors to identify the most important long term value drivers. We typically like the longer term value drivers and drivers we understand, and that are predictable. We also pay a great deal of attention to the larger drivers – or the “megatrends”, if you will – where we find the large currents in capital movement. These could be e.g. shifts in technology or the transition to renewable energy.

After we have established a rational primary explanation for the price trends to continue, we attempt to invest in sectors and stocks we believe have a promising longer term outlook. We employ bottom-up traditional fundamental research on the companies to confirm that the positive price trends should continue. If we believe we have a match between our trend analysis and our fundamental research, we will normally invest in what we believe are the highest quality positive trending stocks within a range of different sectors.

Quality in the companies

As a long-term investor we are conservative in our fundamental research. We firmly emphasise the typical quality factors. We typically assess quality factors such as quality of management, competitive advantage, pricing power, and barriers to entry. Furthermore, assessment of a company’s business model is important as we strongly favour proven business models. We also emphasise the scalability in a business model, so that there is sufficient margin potential in addition to a good top line potential.

After we have assessed the fundamental outlook in a company, we evaluate the company’s balance sheet. Since we dislike highly indebted companies, we are conservative in this respect as well.

Lastly we take a stance on the pricing of the stock. Here we use our understanding of the company’s earnings power the coming years and see today’s pricing in relation to our earnings growth outlook. If there is a mismatch between pricing and our assessment of the longer term earnings outlook we refrain from investing in the stock.

Profitability first, valuations second. We are not looking for the cheapest stocks, nor do we search for companies with the steadiest earnings (such as “low volatility” stocks) throughout the cycle. Instead, we are looking to invest in companies that we have identified as having the best earnings prospects over the next two to three years.

Sales dicipline

If a company’s share price trend becomes negative the stock is either partially sold or sold off completely. A stock can also be sold purely on fundamentals, for example if we believe the company has become too expensive, increased political risk, other structural changes, or if we see better investment opportunities elsewhere. In other words, if the fundamentals mirror the trend, then we are in the sweet spot. If not, stocks are being sold because of changes in the fundamentals and/or trends.